HR One's Guide to Navigating Coronavirus and the Workplace

As we all find ourselves in an unprecedented and rapidly evolving situation regarding COVID-19 (Coronavirus) we know many of you have questions about your ongoing human resources and payroll services. We appreciate the trust our clients place in us. Rest assured, HR One has a thorough plan in place for continuing operations moving forward. We are confident in our ability to provide essential services to our clients.

We have prepared this guide to help our clients navigate the rapidly changing situation they face as employers. You should check back regularly for the latest updates.

General Coronavirus Information

What do we know?

|

Coronavirus is a respiratory virus that appears to have originated in or around Wuhan China in late 2019. It is a contagious illness and is fatal among certain vulnerable populations, including the elderly and those with weakened or compromised immune systems. It has spread to dozens of countries across the world, including the United States. Coronavirus appears to have an incubation period of seven to fourteen days, which is the time between when a person is infected and when symptoms appear.

What are the symptoms?

For most people who become infected it appears that the symptoms range from moderate to mild symptoms that include a cough, fever, and difficulty breathing.

What limits the spread of Coronavirus?

Regular handwashing for a period of at least twenty seconds is one of the most effective steps you can take to limit the spread of Coronavirus. You should also cover your mouth and nose when sneezing or coughing. Likewise taking steps to disinfect or sanitize objects like door handles, your mobile phone, and other objects or surfaces subjected to frequent touching, can also reduce the risk of becoming infected.

Social distancing- staying home, avoiding crowds and refraining from touching one another. Limit your trips to places like the grocery store to off-peak hours. If you have the ability to work remotely you should.

The Centers for Disease Control has put together a resource page for businesses that can help you prepare for a possible Coronavirus outbreak and assist you in creating a plan. The CDC has also prepared a guide for those who are sick with COVID-19 that contains good information.

|

For employees who are able to work remotely from their homes you should begin to think about a work-from-home policy to set appropriate expectations both for what you expect of you team and what they can expect from you. Consider how you will approach the following:

HR One can help you craft a remote working policy to distribute to your employees who are able to work from home during this time.

NYS Executive Order on Essential Businesses

On March 18, 2020, Executive Order 202.6 (or as revised) directed that all businesses and not-for-profit entities in New York State, shall utilize, to the maximum extent possible, any telecommuting or work from home procedures that they can safely utilize.

It is further directed that, no later than March 22, 2020 at 8 p.m., each or-profit or not-for profit employer (excluding state and local governments and authorities) shall reduce the in-person workforce at each business/work location by 100% from pre-state of emergency declaration employment levels.

ESSENTIAL BUSINESSES OR ENTITIES, including any for profit or non-profit, regardless of the nature of the service, the function they perform, or its corporate or entity structure, are not subject to the in-person restriction. (Essential Businesses must continue to comply with the guidance and directives for maintaining a clean and safe work environment issued by the Department of Health).

This guidance is issued by the New York State Department of Economic Development d/b/a Empire State Development and applies to each business location individually and is intended to assist businesses in determining whether they are an essential business and steps to request such designation. With respect to business or entities that operate or provide both essential and non-essential services, supplies or support, only those lines and/or business operations that are necessary to support the essential services, supplies, or support are exempt from the restrictions.

For purposes of Executive Order 202.6, “Essential Business,” means:

Essential health care operations including

|

Essential infrastructure including

Essential manufacturing including

|

Essential retail including

|

Essential services including

|

|

News media Financial Institutions including

|

Providers of basic necessities to economically disadvantaged populations including

|

|

Construction including

|

Defense

|

|

Essential services necessary to maintain the safety, sanitation and essential operations of residences or other essential businesses including

|

Vendors that provide essential services or products, including logistics and technology support, child care and services:

|

If the function of your business is not listed above, but you believe that it is essential or it is an entity providing essential services or functions, you may request designation as an essential business.

To request designation as an essential business, please click here. (All fields of this form must be completed to be considered for exempt designation.)

Restrictions on requesting designation as an essential business:

Update to the Executive Order on Wearing Masks

|

Governor Cuomo updated the order to require employees in essential businesses to wear masks when they are in direct contact with customers and/or the general public. Furthermore, employers are required to provide the masks. This will be effective at 8:00 PM on Wednesday April 15th.

The Department of Health has issued guidance on this new requirement: Essential businesses, as well as state and local government agencies and authorities, must procure, fashion, or otherwise obtain face coverings and provide such coverings to employees who directly interact with the public during the course of their work at no-cost to the employee.

Here is a resource from the CDC on the use of face coverings and masks.

Layoffs and Unemployment Insurance Benefits

Given the rapidly evolving situation regarding nationwide and local efforts to slow the spread of COVID-19 (Coronavirus) some employers are increasingly finding themselves in a difficult situation, forced to reduce their workforce. Whether they are in a business closed by government order, such as a restaurant or a gym, or because they are impacted by the effects of a downturn in demand, travel, etc., difficult decisions are being made when it comes to employees. If your business is either closed or operating at reduced levels and needs to lay off employees or cut back on their hours, you need to be familiar with your options.

Reduction in Hours - If an employee has their hours reduced, and as a result are working less than four days in a week, they may receive partial benefits.

Reduction in Force - If you no longer have work for your employees, they are likely eligible to collect unemployment insurance benefits.

In this case you can make the process easier on yourself and your employees filing for benefits by filling out the employer information on the Record of Employment form and providing it to them.

|

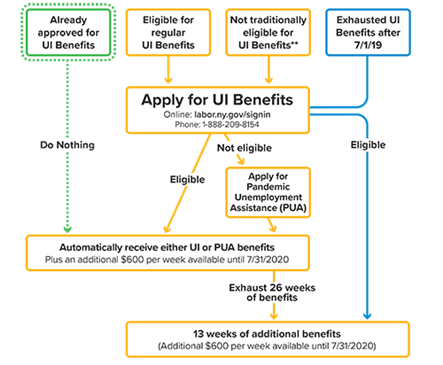

Unemployment Insurance Benefits and the CARES Act

The CARES Act is a federal COVID-19 relief law which was enacted on Friday, March 27, 2020. Part of the law provides additional unemployment insurance benefits and creates Pandemic Unemployment Assistance (PUA). PUA is intended for those individuals who have not traditionally been eligible for unemployment insurance benefits, including independent contractors and the self-employed. The CARES Act also provides for up to 13 weeks of additional benefits. Finally, for all individuals who receive eithe traditional UI or PUA, they will receive an additional $600, available through the end of July.

The $600 PUA benefits have expired. See our update below.

Who Qualifies for PUA?

For individuals filing for unemployment benefits (including PUA and partial benefits):

Whether you think you qualify for traditional UI benefits or PUA, New Yorkers will be able to simply fill out one form to get the correct benefits. When filing you will need the following information:

Normally there is a seven-day waiting period before an applicant can receive benefits, but New York has waived that requirement for people who are out of work due to COVID-19 closures or quarantines.

New York has implemented some specific procedures for filing during this time due to an expected surge in claims. If you are filing a new unemployment insurance claim, the day you should file is based on the first letter of your last name.

Filing later in the week will not delay payments or affect the date of a claim, since all claims are effective on the Monday of the week in which they are filed. Any claim you file will be backdated to the date you became unemployed. If you are eligible, you will be paid for all benefits due.

Here is a step-by-step process to file a claim online and here is a benefit rate calculator to help estimate benefits. Here's a fact sheet on claiming your weekly benefits.

If you have already applied for and/or have been approved for UI benefits, you do not need to take additional action at this time.

Update on Extended Unemployment Benefits from NYS Department of Labor:

New York State has been approved for a FEMA grant under President Donald Trump’s Lost Wages Assistance program. FEMA’s grant funding will allow New York to provide an additional $300 per week on top of the state unemployment benefit to those unemployed due to COVID-19. FEMA will work with New York Governor Andrew M. Cuomo to implement a system to make this funding available to New York residents.

On Aug. 8, 2020, President Trump issued an Executive Order making available up to $44 billion from FEMA’s Disaster Relief Fund to provide financial assistance to Americans who have lost wages due to the COVID-19 pandemic. This program is intended as a replacement for the Pandemic Unemployment Assistance payments of $600 per week that ran from April through July 31.

The timeline for implementation of the Lost Wages Assistance program is still unknown. In addition to the fact that the legality of the Executive Order has been questioned, the state will still need to reconfigure their existing systems to account for and distribute the funds. The availability of the funds may also be limited as the Executive Order expires on December 6, 2020, and caps the total amount available nationwide to $44 billion. That $44 billion could run out after as little as five weeks if all states are approved to participate in the program. Currently, 30 states have been approved.

What does this mean for individuals collecting unemployment?

If employers furloughed or laid off employees due to COVID-19 and have not returned to work, they may become eligible for these additional benefits. It will take time before they see the funds released. The $300 weekly benefit will be retroactive to August 1, 2020. It will only run through early December or until the funds run out.

We anticipate no additional action will be required by individuals who are currently certifying for benefits weekly, the additional funds will be paid out by the state in addition to regular benefits.

What does this mean for employers?

At this point, there is no action required of employers. The $300 weekly payment will not impact the employer’s experience rating.

However, if employers have work available and employees resist returning to work to continue to collect benefits then the employer may choose to protest those claims. Contact HR One for more information.

What does this mean going forward?

The President’s Executive Order was signed after Congress failed earlier this summer to reach a deal on extending (either with or without adjustment) the $600 Pandemic Unemployment Assistance payments under the CARES Act. Unless or until there is an extension of some kind that both the House and Senate can agree to, it is unlikely that there will be any additional extension until 2021, as the President is also limited on the FEMA funds he can access and disperse as grants.

December 2020 Stimulus

There is a $300 weekly supplemental unemployment benefit, through March 14, 2021 as well as an extension of Pandemic Unemployment Assistance (for independent contractors, gig workers and the self-employed) and Pandemic Emergency Unemployment Compensation (for those who run out of state unemployment insurance benefits), through March 14, 2021.

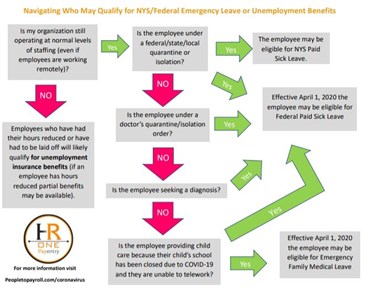

To address the immediate need of employees affected by COVID19 who are subject to mandatory or precautionary orders of quarantine or isolation, New York introduced paid leave provisions that went into effect immediately on March 18.

The bill includes the following provisions:

NYS Paid Family Leave for COVID-19

|

The new law guarantees job-protected paid leave to workers who are subject to an order of mandatory or precautionary quarantine or isolation for COVID-19, issued by the state of New York, the Department of Health, local board of health, or any government entity duly authorized to issue such order, or whose minor dependent child is under such an order.

Most employees will get financial compensation through a combination of benefits. These benefits are not available to employees who are able to work through remote access or through other means.

Application for COVID-19 Quarantine PFL/DB for Self

Application for COVID-19 Quarantine PFL for Child

Federal Sick Leave and Emergency Family Medical Leave (Take Effect April 1, 2020)

Paid Sick Leave- This provision applies to employees who are impacted by one of the following conditions:

This paid sick leave must be available to all employees, upon hire, as follows:

Pay is 100% of the employee’s regular rate for qualifying reasons 1-3 above, capped at $511/day. Pay is 2/3rds of the employee’s regular rate for reasons 4-6 above, capped at $200/day.

This benefit expires December 31, 2020.

Employers may not require employees to use other paid leave benefits before this paid leave.

Employers will be eligible for tax credits. Eligible employers are entitled to a fully refundable tax credit equal to the required paid sick leave. This tax credit also includes the eligible employer's share of Medicare tax imposed on those wages and its allocable cost of maintaining health insurance coverage for the employee during the sick leave period (qualified health plan expenses). The eligible employer is not subject to the employer portion of social security tax imposed on those wages. (Eligible employers subject to the Railroad Retirement Tax Act are not subject to either social security tax or Medicare tax on the qualified sick leave wages; accordingly, they do not get a credit for Medicare tax.)

Special Note to Clients: The employee retention credit cannot be utilized by an employer who receives a section 7(a) SBA loan or CARES loan. The delay in payment of employer payroll taxes is not available to employers who received debt forgiveness concerning a loan received under the CARES Paycheck Protection Program.

Emergency Family and Medical Leave to care for a child- The bill includes a temporary expansion of the Family and Medical Leave Act (FMLA) which will expire on December 31, 2020. This specific expansion applies to all employers with fewer than 500 employees. Employers with fewer than 50 employees may be exempt if the imposition of the provisions would jeopardize the viability of the business as a going concern.

|

An employee would be eligible to take up to 12 weeks of job-protected leave if they’ve worked for the organization for at least 30 days. It includes both full and part-time employees.

To qualify the employee must be unable to work or telework to provide childcare to their son or daughter under 18 enrolled in an elementary or secondary school that is currently closed in response to the COVID-19 public health emergency or their childcare provider is unavailable.

The leave will consist of a 10-day waiting period, presumably during which the employee is using paid sick leave as provided above. After 10 days the employee is paid at 2/3rds their regular rate, not to exceed $200 per day, with a $10,000 aggregate cap.

This is job-protected leave, which means once the leave is complete the employee must be returned to the same position or a substantially similar position with the same pay and benefits. Employers with fewer than 25 employees are exempt from this provision if the position no longer exists due to economic conditions or changes to operating procedures caused by the public health emergency.

Certain organizations involved in health care delivery or emergency response are exempt from these provisions.

For HR One Payentry clients, we have been working behind the scenes to create specific earning codes that will make it easy for you to differentiate between the types of leave and accurately track the hours and dollars associated with each.

December 2020 Stimulus Update

Among the highlights employers need to know about are an extended time period for employers to receive tax relief for sick leave pay under the Families First COVID Response Act (FFCRA). These benefits were set to expire on December 31st, however the new bill extends the time period for employers to receive the tax credits to March 31, 2021 on a voluntary basis. It does not provide any additional time for employees who have already used some or all of their benefits under the program.

As it appears that despite vaccine distribution ramping up in the coming months, COVID will continue to disrupt the workplace either directly or indirectly, employers should strongly consider whether maintaining the leave through March 31, 2021 makes sense. If an employer chooses to continue to offer the FFCRA sick leave the same time off and pay provisions will apply to employees. Employers who choose to offer Emergency Family Medical Leave after December 31 will need to provide a new bank of 12 weeks if their regular FMLA year is the calendar year or another fixed 12-month period that resets before March 31.

If an employer chooses to forgo offering FFCRA sick leave then they need to communicate with any employee currently receiving the sick leave that the benefit ends on December 31 and make appropriate arrangements for that employee through other time off or leave policies. For employers in New York, employees may still be eligible for COVID related Paid Family Leave or Disability.

*This is COVID specific leave and separate from the NYS Paid Sick Leave law.

CARES Act Small Business Loans

Paycheck Protection Program

|

Despite the name ‘Paycheck Protection Program’ the SBA loans under the federal CARES Act stimulus program cover a range of business operating expenses, and questions about this program should be directed first towards a lending institution, not your payroll provider. We are happy to work with our payroll clients to generate any necessary reports to substantiate your application, but we strongly advise directing questions to a lending institution first.

This program provides funding that can be used in the eight weeks from loan origination for payroll costs and other allowable designated business operating expenses.

Here are some documents that will help you better understand the program:

COVID-19 Economic Injury Disaster Loan

In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan of up to $10,000 as part of the SBA’s Economic Injury Disaster Loan program. Please see the US Small Business Administration COVID-19 Economic Injury Disaster Loan Online Application at the following site: https://covid19relief.sba.gov/#/

While we will are working hard to assist our clients with many HR-related questions at this time, HR One is not a lending institution and we recommend that you contact your lending institution or the SBA directly for specific questions relating to these programs: https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources

Special Note to Clients: The employee retention credit cannot be utilized by an employer who receives a section 7(a) SBA loan or CARES loan. The delay in payment of employer payroll taxes is not available to employers who received debt forgiveness concerning a loan received under the CARES Paycheck Protection Program.

December 2020 Stimulus Update

An additional $284 billion is allocated for the PPP and eligibility expanded to include all nonprofits, including 501(c)(6) organizations. Businesses that already received a PPP loan will be eligible to get a second one under the new terms. Some of the PPP funds will be set aside for the smallest businesses and community-based lenders; the relief package also provides $20 billion in Economic Injury Disaster Loans for smaller businesses.

Reopening and Bringing Employees Back

|

Governor Cuomo has outlined a process to open based on industry and risk. The process could begin once there is a 14-day period where there is a decline in hospitalizations within a given region. Some regions may reopen faster or slower than others given factors such as hospitalization, new cases, and testing.As New York and other states move forward with plans to reopen the economy employers and employees are wondering what steps they should be taking in order to bring employees back, and how to deal with some of the unique challenges we all face going forward.

The plans will also be impacted by the adoption of protective measures that can be taken by an industry or business, in order to protect employees and consumers. Employers should expect that they will need to provide personal protective equipment (such as facemasks) to employees and practice social distancing to the extent practicable as things reopen.

Currently all of the state is in Phase Four of reopening.

New York has created a Business Reopening Safety Plan template that employers can use to start documenting their reopening plans.

You may also use the New York Forward Business Reopening Lookup Tool to determine when your organization can reopen and/or resume certain operations, and what restrictions may still be in place.

Bringing Back Employees

**Each organization’s reopening strategy and practices will be unique. What follows is general best practices**

|

Start documenting a plan to reopen and bring back employees, starting with which positions are most essential to your operations and what work may be available. As the economy reopens employers may find that available work may be different from before the pandemic, and as a result they may initially only be able to hire back a certain portion of employees or hire them back for modified hours and duties. After identifying these employees, you should communicate with them in a letter that outlines the following:

Employees who have been collecting unemployment insurance benefits and are returned to partial duty may still be able to continue to collect partial benefits. For example, if an individual who was formerly employed full time returns and works fewer than four days in a week and earns less than $504 per week they would likely still be able to receive some unemployment benefits. This could help encourage employees to return to work even if they will have reduced hours.

Depending on the circumstances you may choose to have rehired employees complete new hire paperwork, including a job application, I-9 employment eligibility verification, direct deposit forms, and employee handbook/personnel policy acknowledgments. Any action you take should be applied in a consistent manner with regard to the employees you are bringing back.

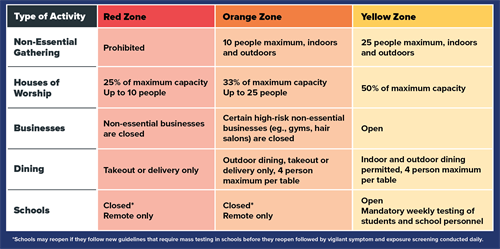

Since the onset of the COVID crisis, New York State has relied on data and metrics, science, and public health expertise to make all decisions regarding economic closings and openings, and other measures warranted to protect the public from COVID. With a low baseline rate of COVID in the general population, New York has the opportunity to identify and limit spread from COVID “microclusters,” defined as outbreaks of new cases within a limited and definable geographic area.

With the fall and winter approaching, New York is implementing a new strategy of aggressively responding to micro-clusters in order to limit COVID spread in a defined geographic area and by doing so prevent broader viral transmission that would result in widespread economic shutdowns. New York’s “Micro-Cluster” strategy contains five key processes:

|

You can review the latest micro-cluster status and guidelines for businesses here: https://forward.ny.gov/cluster-action-initiative

As the year comes to a close the President has signed a $900 billion stimulus bill passed by Congress last week. While the headlines have been dominated by news of the amount of individual relief checks and municipal bailouts, there are several provisions that will impact employers. Below are some of the highlights, but HR One clients should contact us with any specific questions.

COVID Related Federal Sick Leave* and Emergency Family Medical Leave

Among the highlights employers need to know about are an extended time period for employers to receive tax relief for sick leave pay under the Families First COVID Response Act (FFCRA). These benefits were set to expire on December 31st, however the new bill extends the time period for employers to receive the tax credits to March 31, 2021 on a voluntary basis. It does not provide any additional time for employees who have already used some or all of their benefits under the program.

As it appears that despite vaccine distribution ramping up in the coming months, COVID will continue to disrupt the workplace either directly or indirectly, employers should strongly consider whether maintaining the leave through March 31, 2021 makes sense. If an employer chooses to continue to offer the FFCRA sick leave the same time off and pay provisions will apply to employees. Employers who choose to offer Emergency Family Medical Leave after December 31 will need to provide a new bank of 12 weeks if their regular FMLA year is the calendar year or another fixed 12-month period that resets before March 31.

If an employer chooses to forgo offering FFCRA sick leave then they need to communicate with any employee currently receiving the sick leave that the benefit ends on December 31 and make appropriate arrangements for that employee through other time off or leave policies. For employers in New York, employees may still be eligible for COVID related Paid Family Leave or Disability.

*This is COVID specific leave and separate from the NYS Paid Sick Leave law.

Small Business Loans and the Paycheck Protection Program (PPP)

An additional $284 billion is allocated for the PPP and eligibility expanded to include all nonprofits, including 501(c)(6) organizations. Businesses that already received a PPP loan will be eligible to get a second one under the new terms. Some of the PPP funds will be set aside for the smallest businesses and community-based lenders; the relief package also provides $20 billion in Economic Injury Disaster Loans for smaller businesses.

Unemployment Provisions

There is a $300 weekly supplemental unemployment benefit, through March 14, 2021 as well as an extension of Pandemic Unemployment Assistance (for independent contractors, gig workers and the self-employed) and Pandemic Emergency Unemployment Compensation (for those who run out of state unemployment insurance benefits), through March 14, 2021.